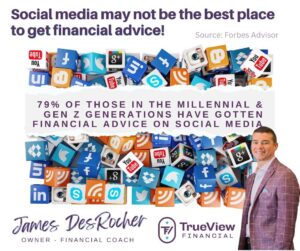

I saw a new report recently with some concerning statistics. Based on a study commissioned by Forbes Advisor, they found that 79% of those in the Millennial and Gen Z generation have gotten financial advice from social media.

I saw a new report recently with some concerning statistics. Based on a study commissioned by Forbes Advisor, they found that 79% of those in the Millennial and Gen Z generation have gotten financial advice from social media.

(Source: Forbes Advisor)

Don’t get me wrong, social media can be beneficial when it comes to sharing financial topics.

The report found that 76% of those surveyed said that social media content around finances makes money talk less taboo, and 62% feel empowered because they have financial advice on their social media feeds.

General advice and best practices (save more, start investing early, pay down debt, etc.) are great for starting conversations, raising awareness, and urging people to start planning their financial future.

Social media platforms are also great for normalizing talks about financial planning, filling in the gap in financial education they may not be getting at home or in school. Offering resources for further education, advice, and guidance can be helpful.

But when financial advice gets too specific, in-depth, or urges someone to take advantage of one offer, product, or service, it can be problematic.

Here are a few thoughts on the dangers of taking important financial advice from social media, especially for younger adults:

1. Social media is not a two-way conversation. When someone gives you a blanket piece of advice for all people and situations be wary. A true financial planner will first ask the important questions to find out your current financial situation, needs, goals, time until retirement, etc.

Without that important context, disseminating financial advice can be not only irresponsible but downright dangerous.

2. You don’t know who is actually giving you financial advice on social media. Is it a certified financial planner, wealth advisor, or someone even licensed? Or just a content creator or other marketer?

You wouldn’t take advice about fixing your car from just anyone on social media who wasn’t a mechanic, so you definitely shouldn’t take financial advice from someone who is just clipping and pasting from some other source.

3. Remember that with any quick graphic or post on social media, the intent is to capture your attention (and convert clicks, likes, follows, shares, etc.) – not to actually educate or empower you to make great financial decisions.

4. So, you will see that advice is often sensationalized. It is usually also over-simplified, lacking the fine print that explains further when, if, how, and for whom the product, service, or investment strategy is best suited.

5. Many people are just selling a risky platform or service (real estate Airbnb investing, Forex trading, etc.) and disguising it as prudent financial advice. Furthermore, they may not even be offering these “investments” themselves on social media but just selling coaching/a system/handbook, etc.

6. There is no little accountability. Let’s say someone takes financial advice from a social media account and then invests their life savings and hard-earned dollars accordingly …and then it tanks. They lose everything. Who are they going to hold accountable?

7. How do we know it’s true?! On social media, ANYONE can portray themselves as wealthy/successful, etc. They only have to rent a Bentley or stand in front of a private jet and look the part. But you have no idea who they really are, if they’ve achieved any measure of wealth or success, or if they’ve even followed the advice that they’re giving you!

8. Like I always say, if someone has a get-rich-quick, can’t-miss investment strategy, they would just do it themselves and try to keep it as quiet as possible – NOT take the time and effort to share it with the world on social media!

If you have any questions about what financial content you (or your kids) are seeing on social media, or need any personalized, in-depth financial advice at all, please contact me to schedule a cup of coffee so we can go over it together.

You can schedule here.