The top 10 S&P 500 stocks, ranked by market capitalization, have driven significant market performance in recent years. However, a closer examination of past periods with similarly concentrated returns may offer valuable insights for investors.

The top 10 S&P 500 stocks, ranked by market capitalization, have driven significant market performance in recent years. However, a closer examination of past periods with similarly concentrated returns may offer valuable insights for investors.

Over the past two years, the largest U.S. stocks have largely dictated market returns. This trend was especially prominent from early 2023, fueled by excitement over artificial intelligence and the strong performance of the technology and consumer discretionary sectors.

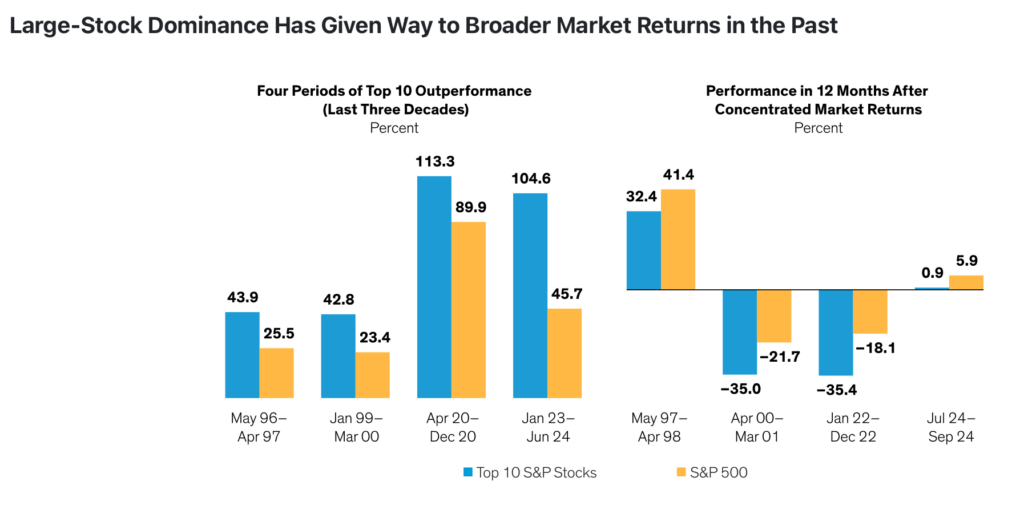

Between January 2023 and June 2024, the top 10 stocks in the S&P 500 delivered a remarkable cumulative return of 104.6%—more than twice the return of the broader index (see Display).

Since July, however, the landscape has begun to shift.

The S&P 500 rose 5.9%, surpassing the returns of the largest stocks, which saw performance diverge sharply during the third quarter.

While it remains uncertain whether this pattern will continue, reflecting on similar historical periods can help investors better navigate changing market dynamics.

Past performance does not guarantee future results.

***

Sources:

Bloomberg, S&P and AllianceBernstein (AB)

https://www.advisorpedia.com/strategists/what-happens-after-the-top-10-stocks-outperform/?utm_campaign=G-KM0EGFP0NS&utm_content=294c95132cee01ec8d2c96e296057bf6&utm_medium=email&utm_source=Robly.com

***

Investment Advisory Representative at Park Avenue Securities from 01-2015 to now: Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS). OSJ: 800 Westchester Avenue, Suite N-409 Rye Brook, NY 10573, (914) 288-8800. Securities products and advisory services offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America (Guardian), New York, NY. PAS is a wholly-owned subsidiary of Guardian. TrueView Financial LLC is not an affiliate or subsidiary of PAS or Guardian. TrueView Financial LLC in not a registered investment advisor. CA Insurance License #0M83430

The primary feature of whole life insurance is the death benefit. All whole life insurance policy guarantees are subject to the timely payment of all required premiums and the claims paying ability of the issuing insurance company. Some whole life polices do not have cash values in the first two years of the policy and don’t pay a dividend until the policy’s third year. Dividends are not guaranteed. They are declared annually by Guardian’s Board of Directors.

Policy loans and withdrawals affect the guarantees by reducing the policy’s death benefit and cash values.

This material is intended for general use. By providing this content The Guardian Life Insurance Company of America, Park Avenue Securities LLC, affiliates and/or subsidiaries, and your financial representative are not undertaking to provide advice or make a recommendation for a specific individual or situation, or to otherwise act in a fiduciary capacity. Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents, and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services, and make no representation as to the completeness, suitability, or quality thereof. 7017407.1 Exp 09/26